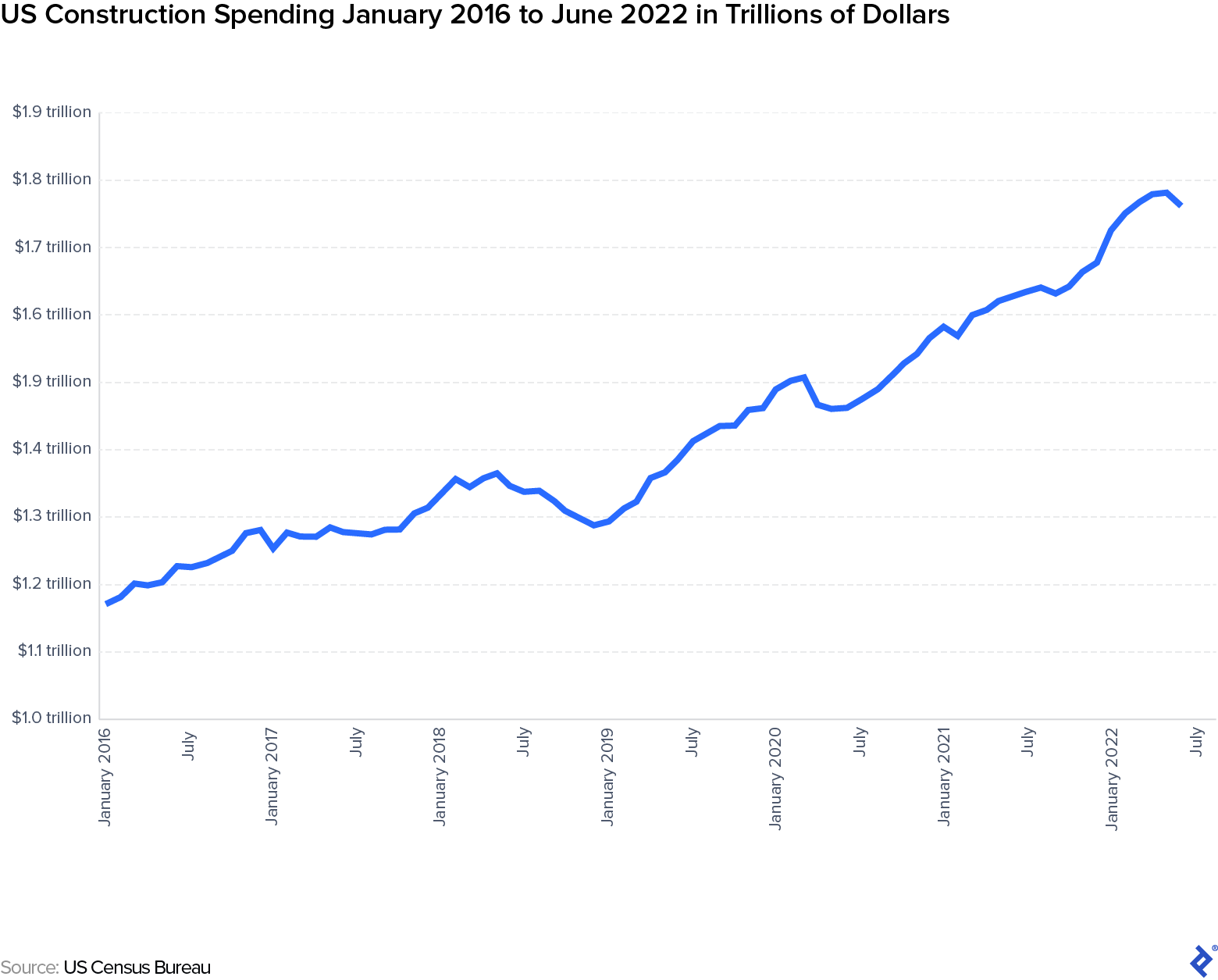

The combination of inflation and rising interest rates isn’t just making homes more expensive to buy—it’s also making them more expensive to build. According to a running tally kept by the US Federal Reserve, the producer price index for construction materials rose from 235 in June 2020 to 350 in June 2022—an increase of 49% in just two years. Consumer price inflation is rising as well, at rates from 5% to 9% in most developed countries, prompting central banks to raise interest rates in response.

Rising costs mean real estate developers have to borrow more, and they often rely on complex funding structures that can eat into profits. As I’ll illustrate, choosing the wrong funding option can add between 1% to 5% to the final price tag—which works out to hundreds of thousands of dollars for a larger project. With commercial construction loans topping $412 billion in July 2022 in the US alone, that could cost the real estate industry billions of dollars every year.

One of the most effective ways for developers to avoid this is to build a real estate financial model before committing to a funding structure. However, they often overlook this step.

I’ve worked in real estate finance for more than 15 years, securing financing for more than 100 commercial real estate projects, including homes, hotels, and commercial properties. I’ve observed that many developers tend to focus their attention on day-to-day demands and have less experience evaluating major financing decisions and understanding all the nuances. They may not take advantage of a real estate development financing model at all, or they may try to do it themselves rather than employing a financial modeling expert.

These models often oversimplify or use inaccurate assumptions that will skew the results. This issue can be exacerbated when a developer uses complicated finance structures that include junior debt and third-party equity. Even for financial professionals, who are familiar with the mechanics of structured finance, this kind of funding can be tricky.

Real estate finance is a unique business, and it’s difficult to model without understanding the underlying assumptions. Below, I detail three common mistakes I’ve witnessed over the years and explain how smart modeling can help you avoid them.

How Real Estate Projects Are Financed

A real estate development project is typically funded using a combination of third-party senior debt and equity. It’s also common to bring in further funding from junior debt and/or third-party equity investors as project costs mount.

Senior debt lenders take a “last-in, first-out” approach to funding projects. This means they expect to see all subordinated finance invested before they release any funds. The senior lender then funds costs to project completion, at which point it gets repaid first.

As in most funding structures, senior debt has the strongest security and ranks first in the capital stack, thus carrying the lowest cost burden: a relatively low interest rate and few fees. Junior debt carries a higher interest rate, and equity participates in the project profits and sometimes also carries a priority return.

To illustrate the effect of various combinations of these financing options, let’s use a simple hypothetical construction project called “Project 50.” The Project 50 community consists of 50 single-family homes, each worth $1 million when construction is complete.

Some assumptions to guide our real estate modeling:

- Total end value (also known as Gross Development Value or GDV): $50 million

- Cost to purchase land: $15 million

- Total construction costs (excluding financing costs): $20 million

- Construction phase: 18 months

- Financing costs: To be determined

Real estate projects require a lump sum of funding upfront to acquire the site. In our example, this is $15 million. After that, the developer makes monthly drawdowns to cover construction costs as the project progresses.

Typically, drawdowns can vary from month to month as outlays change and build-cost inflation occurs. For the purposes of this article, however, let’s assume Project 50 requires 16 equal drawdowns from the $20 million construction cost—meaning $1.25 million will be needed at the end of each month, up to and including month 16.

The construction costs are forecast upfront by both the developer and the lender, with the lender employing a third-party surveyor to monitor the costs and sign off on monthly drawdown requests during the project.

A construction project usually won’t generate any revenue until the construction is complete and the property is ready to occupy, which means the interest charged by the lenders is accrued and compounded over the term of the project. Choosing the wrong blend of financing can mean paying more interest than necessary.

Mistake 1: Misusing WACC to Determine the Best Blend

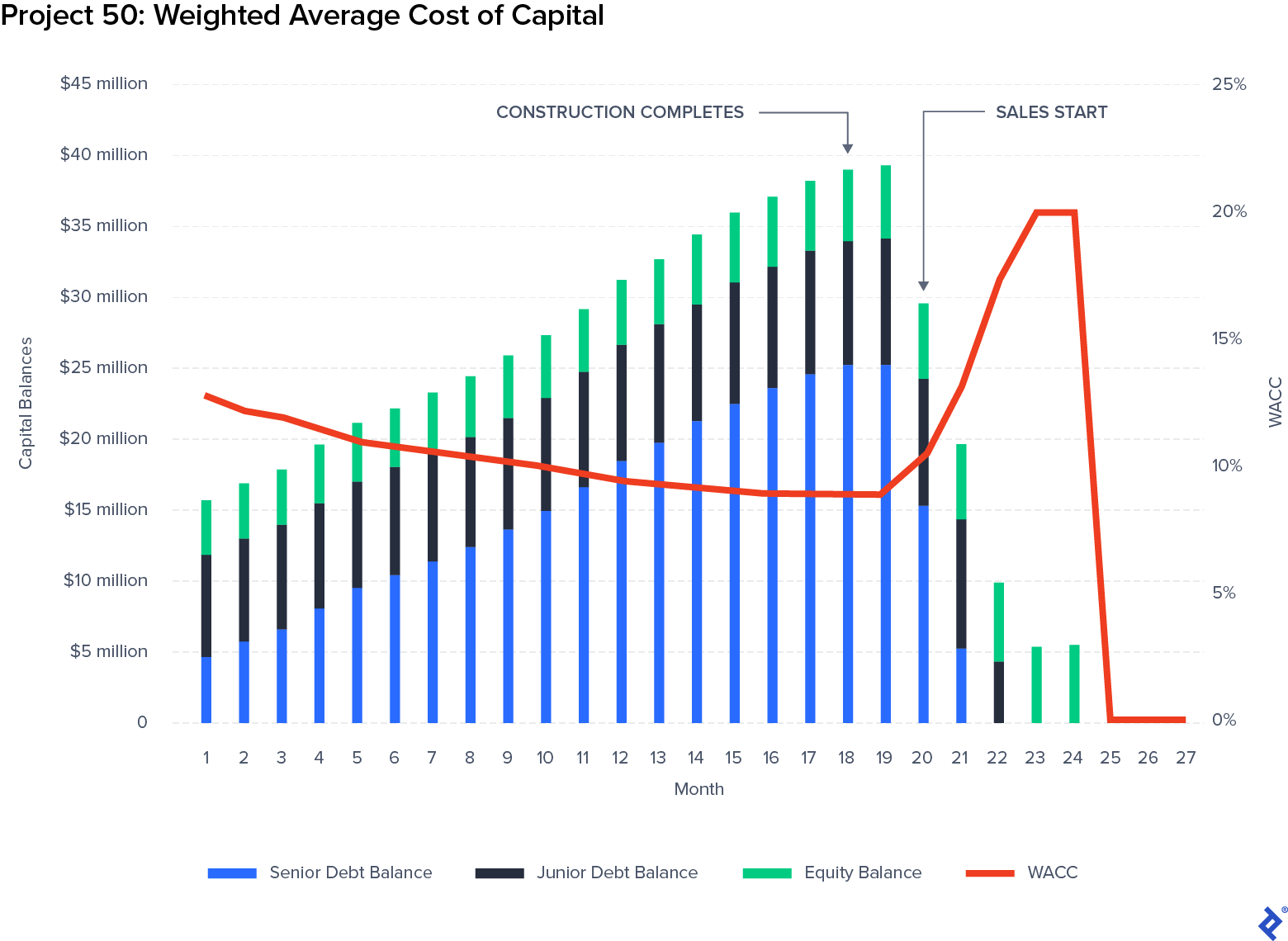

A key metric for identifying the break-even point for a project is the weighted average cost of capital, or WACC.

I’ve seen many real estate developers and even some funders make the error of choosing the cheapest blended rate based on the WACC when the senior loan is fully drawn and before sales start repaying any debt. This is a tried-and-true method for optimizing funding in some areas of finance, such as structured company acquisitions. However, on a building project, this shortcut could lead you to significantly underestimate financing costs.

When you’re financing an acquisition, all the capital is deployed upfront. In real estate development, only the secondary debt is deployed upfront, while the much larger senior debt is drip-fed into the project month by month. That means the bulk of that loan may only be drawn for a few months before it starts to be repaid.

The higher-interest junior debt and equity will accrue interest from the first day until the real estate investments are redeemed through sales or leases (or, in some cases, refinancing). The result is that the WACC is at its lowest point when the senior debt is finally fully deployed and then shoots up when that debt is cleared, as this chart shows.

This rise is sometimes inevitable, particularly for projects where sales happen gradually, such as a build-to-sell single-family home development. However, modeling potential finance structures can help you identify the best way to minimize it.

To show how this works for Project 50, let’s take the headline numbers and apply two sets of funding options—one offering slightly lower WACC than the other, which is based on fully drawn funds.

| Option A | Cost of Funds % | % of Total Costs Funded |

|---|---|---|

| Senior Debt | 5% | 70% |

| Junior Debt | 14% | 20% |

| Third-party Equity | 20% | 10% |

| WACC on Fully Drawn Funds | 8.30% |

| Option B | Cost of Funds % | % of Total Costs Funded |

|---|---|---|

| Senior Debt | 7% | 85% |

| Junior Debt | 14% | 8% |

| Third-party Equity | 20% | 7% |

| WACC on Fully Drawn Funds | 8.47% |

In Option A, senior debt funds 70% of costs, while in Option B, senior debt covers 85%. The costs of the junior debt and third-party equity are the same in both examples. The net result is the simple WACC, based on fully drawn funds, looks marginally higher in Option B. Option A’s senior debt, which makes up 70% of the total costs, also looks a lot cheaper at 5% compared to B’s 7%.

This initial review might be enough for many developers to push ahead with Option A, but let’s look at how these numbers work in a simple real estate Excel model.

As mentioned earlier, we’re assuming the senior debt for the construction costs is released in 16 equal monthly drawdowns and that the sales come in at a rate of 10 per month between months 19 and 24. The headline costs come out as follows:

| Option A | Total Loan/Investment | Projected Interest |

|---|---|---|

| Senior Debt Balance | $25,483,923 | $1,405,604 |

| Junior Debt Balance | $9,086,159 | $2,005,598 |

| Third-party Equity Balance | $3,841,120 | $1,152,336 |

| $38,411,202 | $4,563,538 | |

| Funding Cost as % of Total Funding | 11.88% |

| Option B | Total Loan/Investment | Projected Interest |

|---|---|---|

| Senior Debt Balance | $32,038,378 | $2,692,209 |

| Junior Debt Balance | $3,814,316 | $859,075 |

| Third-party Equity Balance | $2,698,590 | $809,577 |

| $38,551,284 | $4,360,861 | |

| Funding Cost as % of Total Funding | 11.31% |

We can see from the outputs that the total projected interest for Option B is $202,677 lower than for Option A. This is because the cheaper senior debt in Option A is paid back more quickly from the sales and the more expensive junior debt and equity accrue for longer.

Although the WACC on fully drawn funds is lower for Option A, the option offering the lowest total funding costs is Option B. And, as the example demonstrates, that difference can be significant.

Mistake 2: Overlooking the Interest Allowance

When you’re considering senior debt options, the lenders you approach will have their own models and ways of structuring loans. Most will offer leverage as a percentage of costs and/or the end value. They will then break down the loan to cover construction costs and rolled-up interest, with the remainder being allocated to the site acquisition. However, even if two lenders present the same gross loan amount, the funding breakdown and assumptions might be different—and that will affect the bottom line.

Let’s revisit Project 50 and focus on a scenario where two competing banks offer senior debt at the same leverage level: 60% of the GDV.

Both offer an interest rate of 7%, but let’s say Bank A is much more cautious on sales—perhaps it’s more pessimistic about the effect of a recession on the real estate market. It wants to model the numbers by pushing the sales out across 10 months, with only five units sold per month. Therefore, it offers the same gross loan but a longer term, which results in more rolled-up interest. This larger interest allowance has a significant impact on the structure of the funding, as we see in the key outputs in the following model.

| Bank A | Bank B | |

|---|---|---|

| Gross Loan Amount | $30,000,000 | $30,000,000 |

| Construction Costs Covered | $20,000,000 | $20,000,000 |

| Interest Rollup Allowance | $2,908,459 | $2,447,376 |

| Site Advance | $7,091,544 | $7,552,624 |

First, note that although the difference in the interest projected is around $460,000, this is only the projected interest—the developer pays interest only on drawn funds, so if it surprises Bank A and does manage to hit the more ambitious sales target, it would, in practice, pay the same interest to Bank A as to Bank B, given that their rates are the same.

But that isn’t the only reason Bank A is the better option. The larger site advance from Bank B means the developers would need to find an additional $461,083 of junior debt or equity for the site acquisition to cover the additional interest accrual, which will also impact their funding costs.

Junior debt can run at around 15% per annum in interest plus, say, 2% in fees. Therefore, if a senior debt lender requires an additional $460,000 of junior debt, that could cost the developer approximately $157,500 in additional junior debt costs over a two-year term.

Mistake 3: Failing to Model the Exit Strategy

When assessing a real estate project, funders want to know the developer’s exit strategy. The funding for construction is normally short term (one to four years) and intended to be repaid when the building work is complete. Even if a developer holds on to the completed project longer term, it will normally refinance the funding to a cheaper long-term loan once the construction is complete.

Competing options for sale or refinance post-construction can be complicated to evaluate alongside different funding. However, not modeling the impact of the exit strategy can cause borrowers to miss key details that affect the optimal financing structure.

If the builder is not refinancing or selling the entire property at once, repayment of construction funding typically happens piecemeal through individual sales—as it might with a community of single-family homes.

Let’s assess the effect of different exit strategies for Project 50 if we compare two exit routes and two funding options. The first exit strategy—the immediate exit—is a bulk sale or refinance in month 19, after construction is complete. The second exit strategy—the slow exit—will be drip-feeding sales into a slow market, with sales coming through in equal amounts from month 22 to month 30.

For the purposes of comparison, let’s introduce a new funding option to evaluate alongside the winner of our comparison above, Option A. Some specialist funds offer what they refer to as “stretched senior debt” where they effectively offer the senior debt and junior debt under a single facility. We’ll call this Option C.

| Option C | Cost of Funds % | % of Total Costs Funded |

|---|---|---|

| Stretched Senior Debt | 8% | 90% |

| Junior Debt | – | – |

| Third-party Equity | 20% | 10% |

| WACC on fully drawn funds | 9.20% |

The rate of interest charged for stretched debt loans will typically be higher than traditional senior debt at lower loan-to-value ratios. Here, Option C’s rate is 8% while Option A’s senior debt rate is 5%. At a glance, Option C’s WACC, based on fully drawn funds, is also higher—9.2% compared to Option A’s 8.3%.

The “right” option may seem clear, but depending on a developer’s strategy, they shouldn’t be too quick to dismiss Option C. Let’s look at how the numbers change based on two different exit strategies.

Exit 1: Immediate

| Option A | Total Loan/Investment | Projected Interest |

|---|---|---|

| Senior Debt Balance | $25,352,386 | $1,217,694 |

| Junior Debt Balance | $8,722,813 | $1,643,638 |

| Third-party Equity Balance | $3,786,133 | $1,135,840 |

| $37,861,332 | $3,997,172 | |

| Funding Cost as % of Total Funding | 10.56% |

| Option C | Total Loan/Investment | Projected Interest |

|---|---|---|

| Stretched Debt Balance | $34,091,737 | $2,879,708 |

| Third-party Equity Balance | $3,787,971 | $1,136,391 |

| $37,879,708 | $4,016,099 | |

| Funding Cost as % of Total Funding | 10.60% |

The difference in the two funding options is marginal when modeled for an immediate refinance, with Option A coming in at $18,937 less.

Exit 2: Slow

If we model the exit strategy as a longer process of individual sales between month 22 and month 30, we get the following figures:

| Option A | Total Loan/Investment | Projected Interest |

|---|---|---|

| Senior Debt Balance | $25,689,579 | $1,699,398 |

| Junior Debt Balance | $9,595,290 | $2,506,012 |

| Third-party Equity Balance | $3,920,541 | $1,176,162 |

| $39,205,410 | $5,381,572 | |

| Funding Cost as % of Total Funding | 13.73% |

| Option C | Total Loan/Investment | Projected Interest |

|---|---|---|

| Stretched Debt Balance | $35,231,297 | $4,145,886 |

| Third-party Equity Balance | $3,914,589 | $1,174,377 |

| $39,145,886 | $5,320,263 | |

| Funding Cost as % of Total Funding | 13.59% |

Under the slower exit route of individual sales, Option C comes out slightly lower in costs, at $61,309 less than Option A.

Another reason to model your finance costs is that it may actually reveal the best exit route to take. As you can see from this example, selling the homes off individually over the course of several months costs the developer about $1.3 million more than it would to sell the entire development in bulk or refinance it as soon as construction is complete.

A bulk buyer of completed real estate will often expect a discount. By modeling the finance cost, you can ascertain an appropriate discount. With bulk buyers in short supply and housing markets cooling rapidly in many areas, it’s all the more critical to know early on how to clear that expensive development loan.

Smart Real Estate Financial Modeling Pays Off

As we’ve seen, only by building a complete financial model can you identify the best blend of financing for a real estate development project.

Failing to do so can be costly in a number of ways: For larger projects, choosing a suboptimal funding structure can result in spending hundreds of thousands of dollars more in financing costs. It can also obscure the best exit strategy, leading developers to spend millions on developer loans instead of refinancing or pursuing a bulk sale.

As the costs of building and borrowing rise and demand starts to wane, it’s crucial to understand all the options before moving forward. A financial professional who has on-the-ground experience with construction can help builders choose the optimal real estate structured finance solution.