Bank branch density, defined as the number of bank branches per $1 billion in deposits, has declined significantly over the past decade. While total bank deposits almost doubled between 2016 and 2022, the number of bank branches declined by approximately 15 percent. The decline in branch density, which was facilitated by investment in technology and the proliferation of digital and online banking, contributed to the banking calamity in 2023. The virtuous cycle of growth of deposits that enabled these banks to attract deposits, largely uninsured, became a vicious cycle once a banking run began. Multiple factors affected banks during the 2023 banking panic, including interest rates, risk management, and exposure to the cryptocurrency sector. We do not argue that declining branch density per se caused bank failures. Rather, lower branch densities reflect the nature of the banks’ deposit clientele as being more likely to run on the bank during difficult times.

All three bank failures in March and May 2023 involved banks with low branch density. Their national rank by total assets, total deposits, and number of branches as of 2022 are listed in table 1. Their branch densities were well below the 10th percentile of the branch density distribution in 2022.

Table 1. Bank Failures in 2023

| Failed Bank | Rank by Total Assets | Total Deposits | Number of Branches |

| Silicon Valley Bank | 15th | $175 Billion | 17 |

| Signature Bank | 32nd | $104 Billion | 38 |

| First Republic Bank | 19th | $166 Billion | 87 |

Source: Summary of Deposits.

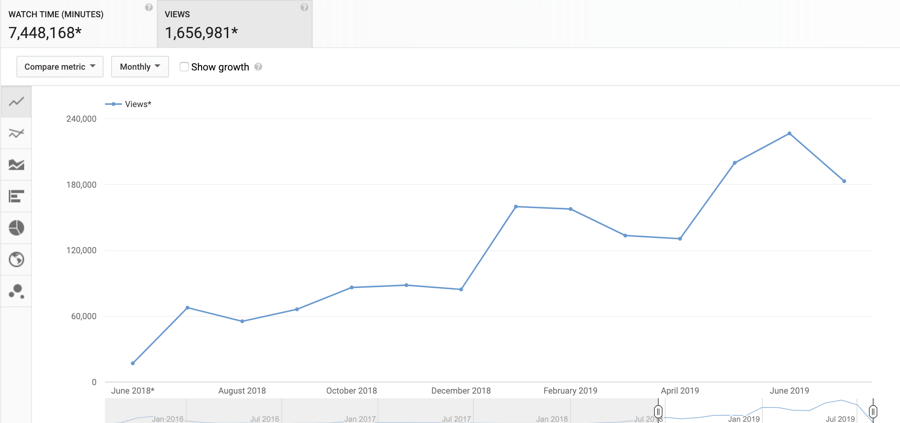

In our paper, “Bank Branch Density and Bank Runs,” we show that the three bank failures were a manifestation of a broader problem, and that low bank branch density, in general, is related to higher deposit instability. Digital banking enables banks with low branch density to grow faster and attract depositors during relatively calm times (figure 1). But when interest rates increased and economic conditions deteriorated, those large deposit inflows took the form of “hot money” and changed its course.

Figure 1: Cumulative Growth of Total Deposits

Source: Benmelech, Yang, and Zator 2023.

Our analysis reveals a positive and statistically significant relationship between bank branch density and stock returns around these bank failures. The results suggest that around the collapse of Silicon Valley Bank, a one standard deviation decrease in branch density is associated with 4 percentage points lower returns (figure 2). Similarly, during the failure of First Republic, a one standard deviation decrease in branch density is associated with 1.4 percentage points lower returns. Our results suggest that lower branch density is associated with significantly lower stock returns in times of uncertainty.

Figure 2. Bank Stock Returns around Silicon Valley Bank’s Collapse and Branch Density

Source: Benmelech, Yang, and Zator 2023.

These lower stock returns likely reflect investors’ concerns about the financial stability of banks with low branch density. We further show that branch density was positively correlated with deposit flows during the first quarter of 2023. A one standard deviation decrease in branch density is associated with a 4.4 percent net outflow of uninsured deposits. Some banks with low branch density continued to attract insured deposits even in 2023, and thus their total deposits did not change significantly. However, among banks that experienced net deposit outflows, those with low branch density suffered larger outflows.

A potential explanation for the poor performance of banks with low branch density in 2023 is based on their deposit clientele. According to this explanation, banks with low branch density attract largely uninsured deposits through digital banking, which provides convenience and speed, which appeal to both corporations and tech-savvy households with large funds to deposit. We show that banks that made large investments in information technology (IT) in the past had lower branch density in 2022. Large investment in IT also resulted in lower stock returns during the distress episodes in 2023.

Although digital banking helps banks to attract deposits during booms, it could have both good and bad consequences, since tech-savvy depositors are more likely to flee and swiftly move their deposits elsewhere during economic turmoil. Consistent with this idea, we find that while the average bank experienced a 27.5 percent surge in webpage traffic in March 2023, banks with lower branch density experienced a significantly higher increase in webpage traffic during that period. The change in online traffic, in turn, negatively and significantly predicted stock returns around the Silicon Valley Bank and First Republic Bank collapses. These results are consistent with both stock returns and increases in online banking web traffic being related to deposit instability.

Our findings highlight the importance of branch density and its implications for deposit stability. Digital banking enables banks with lower branch density to attract deposit flows and expand funding capacity. However, digital banking and low branch density also lessen the value of the bank-depositor relationship—shifting the depositor base to corporations and tech-savvy depositors with large, mostly uninsured deposits. These changes in the composition of banks’ depositor base turn out to be detrimental during market downturns. Digital banks with lower branch density experience larger deposit outflows and worse stock performance.